As a seasoned professional in the realm of mergers and acquisitions, I’ve had the privilege of guiding numerous Acquisition CEOs through the intricate process of buying a business. However, I’ve also witnessed many first-time Acquisition CEOs stumble over the same common pitfalls. Let’s explore the top five mistakes I see new Acquisition CEOs often make when they first consider buying a business. By understanding these missteps, you can better prepare yourself for a successful acquisition journey.

1. Not Conducting Thorough Due Diligence

The first mistake many new Acquisition CEOs make is failing to conduct thorough due diligence. Due diligence is a comprehensive appraisal of a business to evaluate its assets and liabilities and understand its commercial potential. It involves scrutinizing financial records, legal documents, customer contracts, and other critical business aspects.

Skipping or rushing this step can lead to horrible surprises down the line, such as undisclosed liabilities, overvalued assets, or operational inefficiencies. Therefore, it’s crucial to take your time during this phase, employ the services of experienced professionals, and ensure you have a clear picture of the business’s health and potential.

2. Overlooking the Importance of Cultural Fit

Another common mistake is overlooking the importance of cultural fit between the Acquisition CEO and the existing business. The culture of a business is its lifeblood, influencing everything from employee morale to customer satisfaction.

If the Acquisition CEO’s vision, values, and management style clash with the existing culture, it can lead to employee turnover, decreased productivity, and even the loss of customers. Therefore, it’s essential to assess cultural compatibility during the acquisition process.

3. Underestimating the Time and Effort Involved

Acquiring a business is a complex process that requires significant time and effort. Many new Acquisition CEOs underestimate this, expecting a quick and straightforward transaction. However, from due diligence to negotiation, legal processes, and integration, each step can be time-consuming and challenging. The average time to acquire any business in the 1M-5M range is 6 months. That time frame will encompass everything from finding the deal to closing.

Underestimating the time and effort involved can lead to rushed decisions, burnout, and even deal failure. It’s important to plan for this commitment and be prepared to invest the necessary time and resources to ensure a successful acquisition.

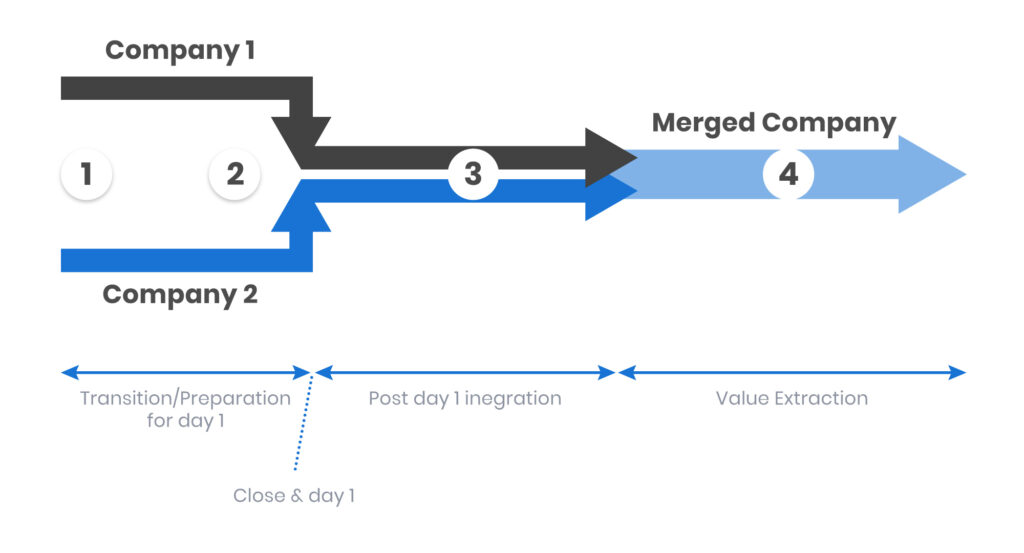

4. Neglecting Post-Acquisition Integration

Post-acquisition integration is a critical phase where many new Acquisition CEOs falter. This phase involves merging the acquired business’s operations, systems, and culture with those of the acquiring CEO or company.

Image Source: Dealroom.net

Neglecting this phase can result in operational inefficiencies, cultural clashes, and a failure to realize the full value of the acquisition. It’s crucial to plan for post-acquisition integration from the outset, considering aspects like system compatibility, employee onboarding, and cultural integration.

5. Failing to Seek Expert Advice

The final common mistake is failing to seek expert advice. The world of business acquisitions is complex and filled with potential pitfalls. Even the most seasoned CEOs can benefit from the guidance of experienced professionals, such as lawyers, accountants, and acquisition advisors.

Failing to seek expert advice can lead to costly mistakes, legal complications, and missed opportunities. Therefore, it’s wise to build a team of trusted advisors who can guide you through the acquisition process and help you make informed decisions.

The Take Away

While the process of buying a business can be challenging, understanding these common mistakes can help you navigate the journey more successfully. Remember to conduct thorough due diligence, consider cultural fit, plan for the time and effort involved, prepare for post-acquisition integration, and seek expert advice. By doing so, you can avoid these common pitfalls and set yourself up for a successful business acquisition.

Ready to embark on a successful business acquisition journey? Avoid common pitfalls and maximize your chances of success by seeking expert guidance. Our team of seasoned professionals is here to support you every step of the way, from thorough due diligence to seamless post-acquisition integration. Don’t let these mistakes hinder your progress – get started today to receive expert advice and ensure a smooth and profitable acquisition process. Let’s turn your business acquisition dreams into reality together!